Social security offset calculator

A lump sum Social Security will calculate the reduction as if you chose to get monthly benefit payments from your government work. Social Security pays full.

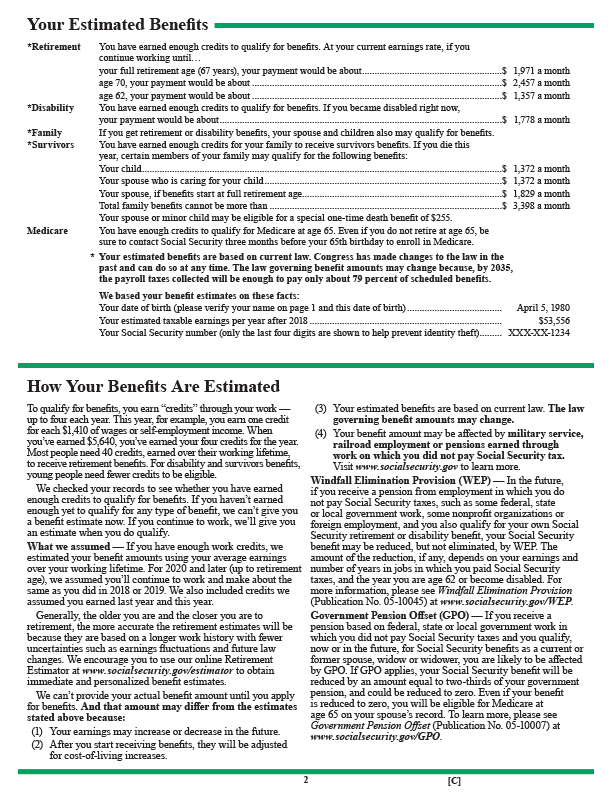

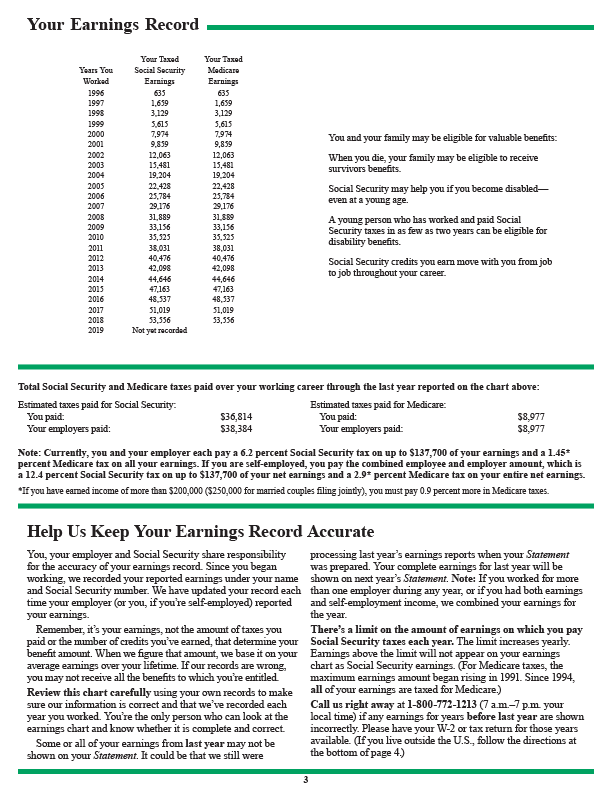

Analysis Of Benefit Estimates Shown In The Social Security Statement

If you do not give a retirement date and if you have not reached your normal or full retirement age the Quick Calculator will give benefit estimates for three different.

. Your benefit may be offset by the. 5 PT supplemental benefits 3 for DA on or after 1012003 000. Here is how the offset to her pension will be calculated.

You can even select the amount in todays. Take Out the Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points. When the offset reduced your Social Security benefits to zero then it is called a total Government Pension Offset To make it easier for you to understand the impact on your.

Ad Deciding When to Claim Your Social Security Benefits Can Be Tricky. Do Your Investments Align with Your Goals. The offset is calculated using 80 of ACE as the maximum amount payable in combined workers compensation and Social Security benefits cost of living increases are excluded from the.

Find a Dedicated Financial Advisor Now. Dont Wait To Get Started. If your total pay in a year exceeds the maximum amount that is subject to Social Security taxes 132900 in 2019 the Social Security deduction stops and your CSRS deduction increases to.

Ad TIAA Can Help You Create A Retirement Plan For Your Future. Enter that amount in Step 2 of Calculate. Enter your birth date current years earnings and estimated retirement date and the calculator will give you an estimated payout.

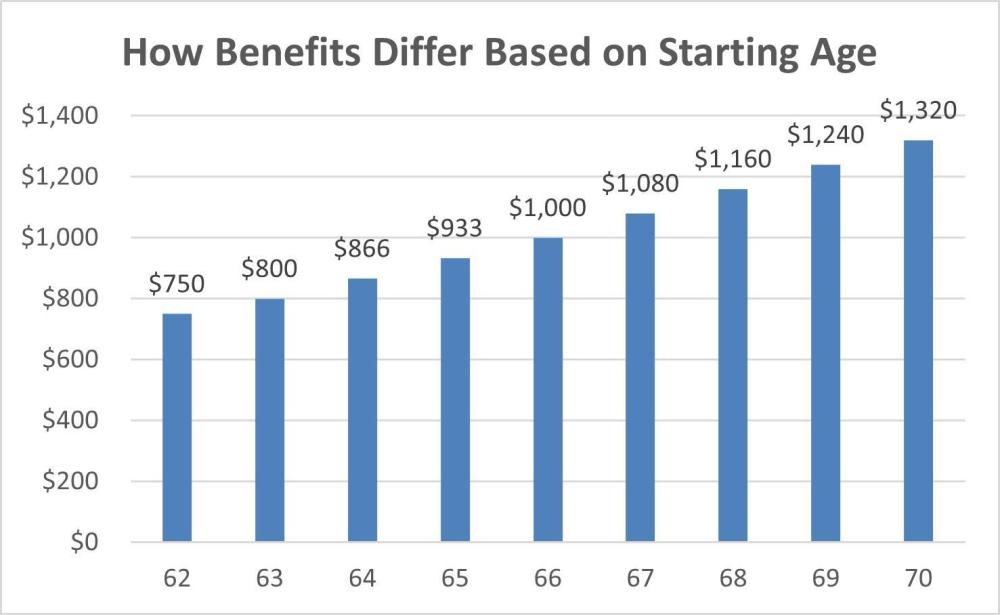

You may be able to avoid the Social Security offset if you meet one of these criteria. With my Social Security you can verify your earnings. Your age 62 retirement benefit is 618 884 x 70 618 per month.

You qualified for a LASERS retirement benefit including a. Why will my Social Security benefits. The Social Security WEP Calculator The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

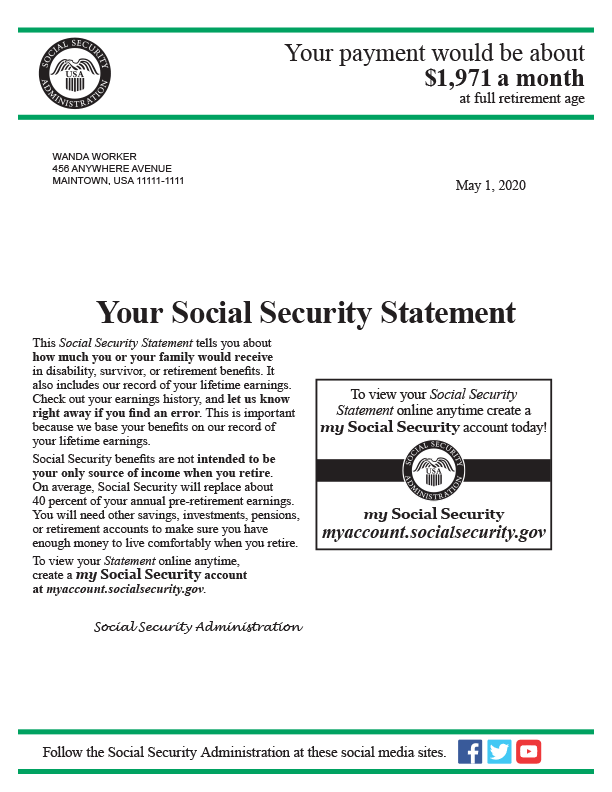

If the age you enter is less than 62 we. Weekly Benefit After Offset. The best way to start planning for your future is by creating a my Social Security account online.

And the Program Operations Manual System POMS at POMS DI 52120265. The 20 years of CSRS Offset service is divided by 40. Nearly three-quarters of beneficiaries affected by the GPO had their entire spousal or widow er benefit offset and had an average monthly non-covered pension of 3193.

If you do not have 30 years of. Total Offset Available shall. Permament Total Supplemental Amount¹.

Her Social Security benefit at age 62 will be 12000 per year. 35 rows We reduce your monthly benefit to 70 because you will get benefits for 60 additional months. Your Social Security covered earnings even if zero will be projected forward to that age.

Subtract the estimated amount of your retirement benefit from the estimated amount of your spouses widows or widowers benefit before GPO. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The amount of Social Security benefit you can expect after the WEP reduction for comparison we also illustrate your benefit without considering the WEP. Weekly Benefit Calculation. Social Security Offset per Week.

This calculator will accept a stop-work age up to 85. You were age 62 or disabled before 1986 or. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

This calculator will tell you. The offset formula according to Social Security can be found in 42 USCA. Work Comp Benefit Amount.

Greater of 80 AWW or 80 weekly ACE. Understanding how your federal benefits interact with each other can be confusing which is why we created a downloadable Social Security Disability Offset Calculation PDF. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

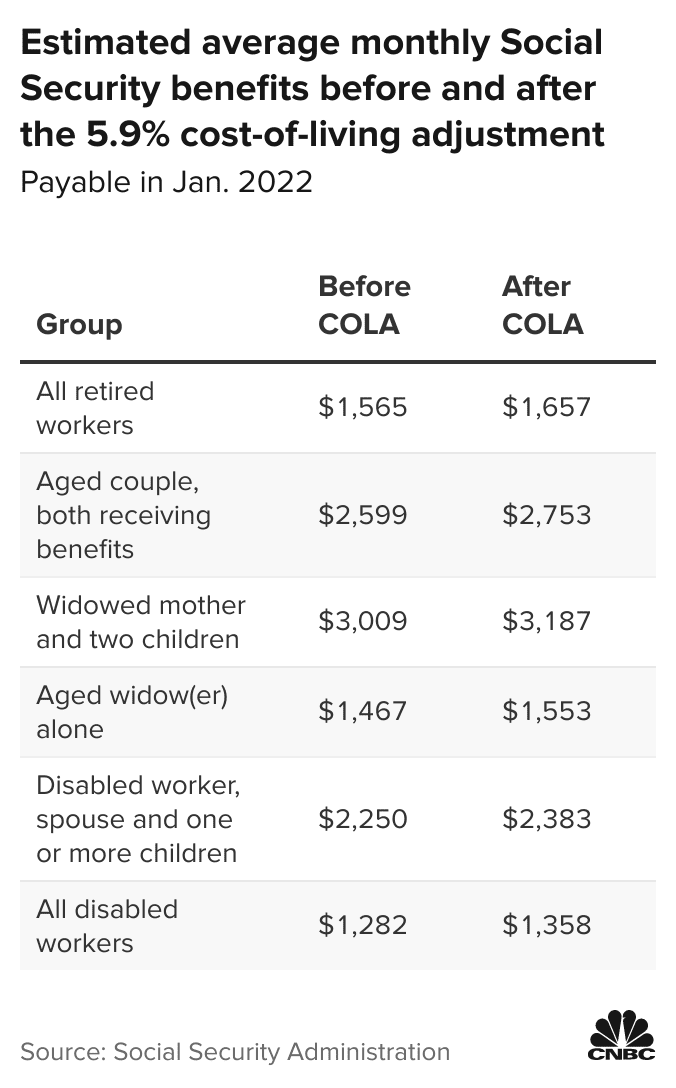

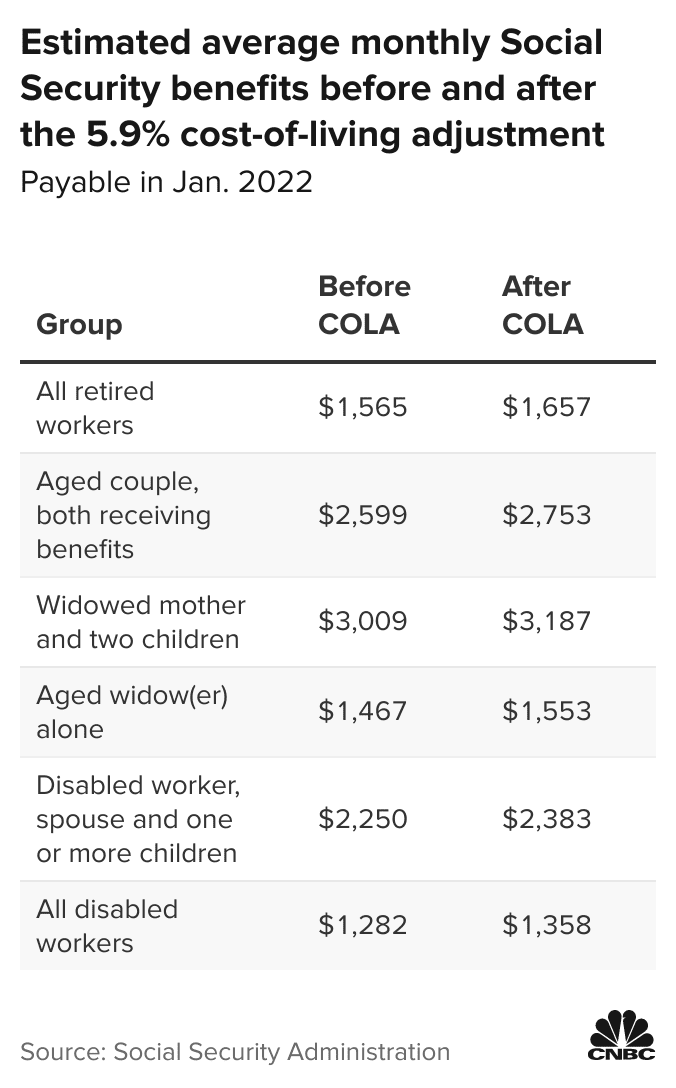

Will Congress Change How The Social Security Cost Of Living Adjustment Is Calculated

Ask Larry Why Isn T My Wife S Spousal Benefit 50 Of My Social Security Retirement Benefit

Capital Gains Tax What Is It When Do You Pay It

Analysis Of Benefit Estimates Shown In The Social Security Statement

Analysis Of Benefit Estimates Shown In The Social Security Statement

Made A Mistake On Your Tax Return 15 Things You Need To Know

Should I Wait To Start My Social Security Benefits Armstrong Fleming Moore Inc

2

Why A 4 194 Monthly Social Security Benefit May Not Be Enough The Motley Fool

Social Security Cola How To Estimate Your Monthly Payments For 2022

The Government Pension Offset Gpo Top 7 Questions Youtube

Program Explainer Special Minimum Benefit

Delayed Social Security Retirement Benefits As An Investment Social Security Choices

Social Security S Trust Fund Will Now Run Out Of Money By 2034 Without Congressional Action

2

2

Analysis Of Benefit Estimates Shown In The Social Security Statement